Okay, so check this out—managing a crypto portfolio on Solana these days? It’s like juggling flaming swords while riding a unicycle. Seriously. You’re not just tracking prices anymore; it’s yield farming, staking rewards, DeFi positions, and a bunch of moving parts that can feel downright overwhelming. My first impression? I was drowning in tabs, spreadsheets, and notifications that made my head spin faster than a Solana validator syncing blocks.

But here’s the thing: I stumbled onto some tools and tricks that actually made sense of the chaos. Not perfect, mind you, but enough to keep me from pulling my hair out every time I open my wallet. Yield farming on Solana is powerful but tracking those rewards? That’s a whole different beast. I’m not 100% sure why it’s so tricky, maybe because so many platforms don’t talk to each other well. Or maybe it’s just me being old-school and wanting a neat dashboard instead of a dozen browser tabs.

Initially, I thought, “Hey, just use any portfolio tracker and call it a day.” But then I realized most of them barely scratch the surface when it comes to the specific tokens and staking programs native to Solana. The ecosystem’s growing fast, but the tooling is still catching up. On one hand, that’s exciting—there’s room for innovation—but on the other, it’s frustrating when you want a quick snapshot of your staking rewards piling up or how your LP tokens are performing.

Whoa! Did I mention how confusing it is when your staking rewards compound automatically? Yes, it’s awesome for earning more, but your dashboard often shows you stale numbers. You end up wondering if you should claim now or wait, and with gas fees (though lower on Solana), it’s not always free to just poke around. Something felt off about the way some trackers handled this, like they didn’t factor in auto-compounding properly, which can skew your actual yield.

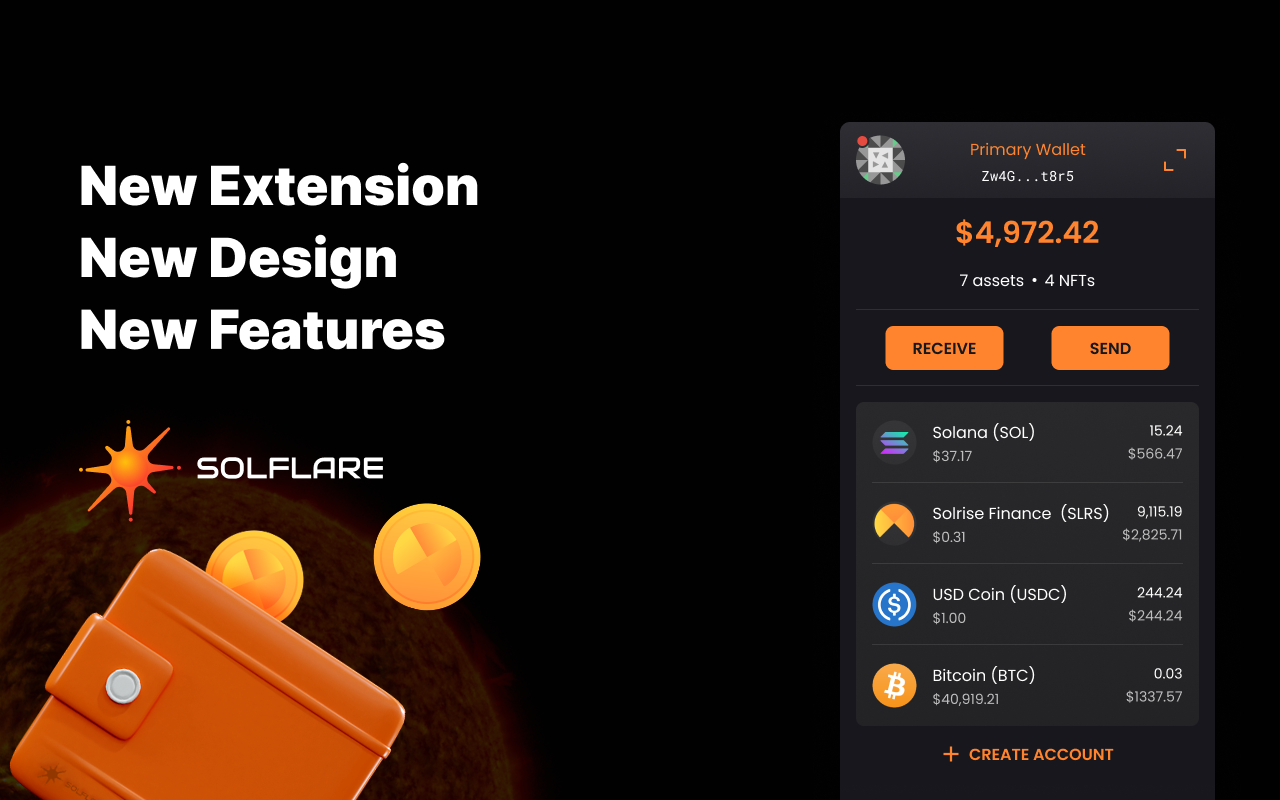

Anyway, after a lot of trial and error, I found myself relying heavily on the solflare extension. Not just because it’s a wallet, but because it gives a surprisingly clear view of your tokens, staking, and DeFi positions all in one place. Plus, it’s integrated with the Solana network in a way that feels native—none of that awkward third-party API lag. I’m biased, but it’s been a game changer for me.

Now, let’s dive deeper into why portfolio tracking in Solana’s DeFi scene is a puzzle worth solving. Yield farming is attractive because it promises high returns, but the mechanics behind it can be a headache. You stake your tokens in a liquidity pool, earn rewards, reinvest them, and somehow hope your dashboard keeps up with all that. Here’s what bugs me about many tools—they often treat your portfolio like a static snapshot, not a living, breathing ecosystem.

Imagine this: you’ve put $1,000 into a liquidity pool that rewards you in another token. That token’s price fluctuates, your staking rewards compound, and there are sometimes bonuses or penalties depending on your lock-up period. Medium sentence here—tracking this manually is a nightmare, and frankly, I don’t have that kind of time. Longer thought incoming: the dynamic nature of these rewards means that a good tracking tool must not only reflect current token prices but also calculate future expected yields, factoring in compounding frequency and potential slippage when you exit positions.

So, why doesn’t every tracker do this right? Well, it boils down to data sources and integration. Solana’s blockchain is fast and cheap, yes, but the data is spread across many smart contracts and protocols with different standards. The solflare extension helps bridge some of this gap by natively connecting your wallet to these protocols, giving you more real-time insight without bouncing between apps.

Hmm… I also noticed that yield farming strategies can be very personal. Some folks prefer stablecoin pools to minimize volatility, while others chase high-risk, high-reward setups with exotic tokens. That means your portfolio tracker needs to be flexible enough to handle these variations. I’m not talking about just ticking boxes, but actually showing you the risk exposure, impermanent loss potential, and realistic reward timelines. There’s a lot of nuance here that most apps miss.

Here’s a wild thought: what if your portfolio tracker could not only display current performance but also suggest adjustments based on real-time market changes? Like a smart assistant whispering, “Hey, your staking rewards are stalling; maybe shift to this pool instead.” It sounds futuristic, but given Solana’s vibrant ecosystem, I wouldn’t be surprised if that’s the next big step.

Check this out—using the solflare extension made me realize how much smoother staking rewards tracking could be when done right. The interface shows not just your balance but breaks down your rewards, pending claims, and even estimated APYs, all in one place. This clarity is crucial because, honestly, if you can’t see your rewards easily, you might miss out on claiming them or optimizing your yield farming strategy.

But don’t get me wrong—there are still gaps. Sometimes the extension doesn’t immediately reflect changes after you unstake or move tokens around, and I’ve had moments where numbers just didn’t add up, forcing me to double-check on-chain data manually. It’s the kind of friction that reminds me we’re still early in this space. It’s not perfect, but it’s miles ahead of juggling multiple disconnected tools.

One thing I learned the hard way is that staking rewards aren’t just about passive income—they’re about timing and strategy. You might think it’s “set it and forget it,” but actually, you want to watch how your rewards accumulate and when it’s best to reinvest or pull out. The solflare extension helps with this, but it’s up to you to stay engaged. This part bugs me a bit because I wish more apps would nudge you or at least send reminders without being spammy.

To wrap this thought up (though I could ramble on), portfolio tracking on Solana is evolving but still feels like a DIY project at times. The solflare extension stands out as a practical tool that blends wallet functionality with staking and yield visibility, but even it isn’t a silver bullet. For anyone knee-deep in Solana’s DeFi, it’s worth trying out and seeing how it fits your workflow. And hey, if you find better tools, I’m all ears—this space moves too fast for anyone to claim they’ve got it all figured out.

So, what’s next? Well, I’m curious to see how portfolio tracking tools handle the upcoming Solana upgrades and the influx of new DeFi projects. Will they keep pace with innovative staking models or fall behind? Something tells me we’ll see smarter, more integrated solutions soon, maybe even AI-driven dashboards that make managing your crypto as easy as checking your bank app.

For now, though, my advice is simple: don’t sweat the perfect tool. Use what works, like the solflare extension, stay curious, and keep an eye on your rewards. It’s a bit of a wild ride, but hey, isn’t that what crypto’s all about?